It would remove health insurance from millions…

The CBO numbers come out soon on this, but even Trump knows they will be bad, so he is preemptively attacking the CBO.

http://www.nbcnews.com/health/health-care/gop-health-care-bill-who-wins-who-loses-tax-credits-n730766

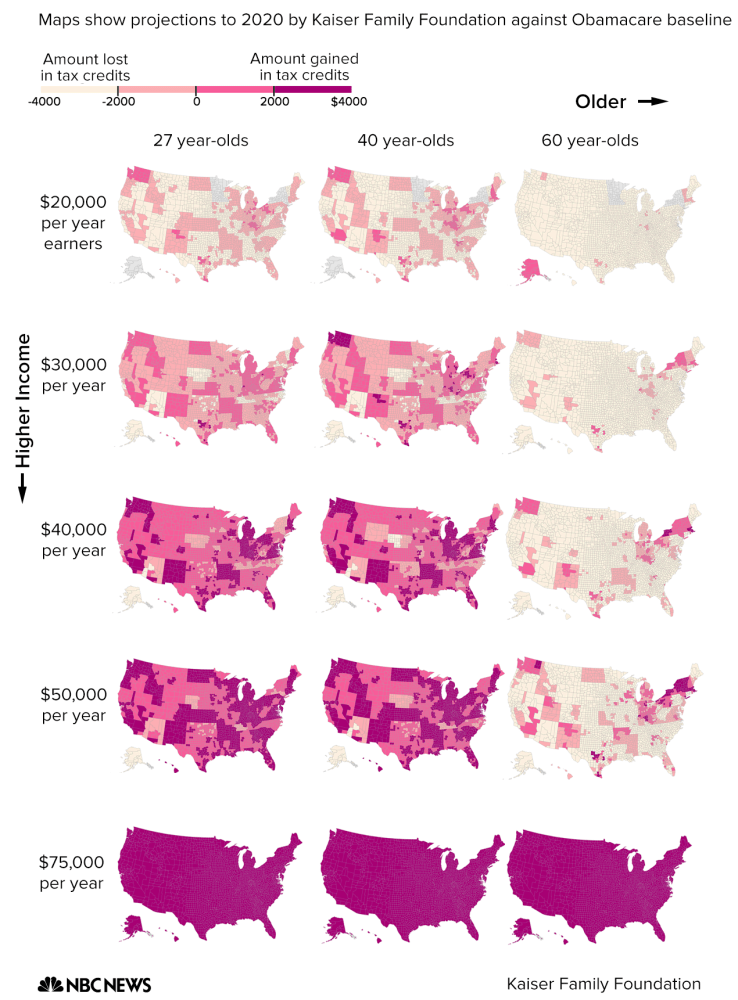

In short, higher-income earners and the young would see a benefit from the Republican bill. Lower-income earners and the old would tend not to.

The reason for the change is all in how the bills provide tax relief for buying health care. Under Obamacare, tax subsidies are partly determined by the cost of local health care and are not given to higher earners. In the House bill, tax credits are pegged to income and age, and are available to higher earners.

Should the House bill pass, Kaiser estimates that single filers making as much as $115,000 will benefit from a tax credit in 2020. Under Obamacare, the maximum amount someone can earn and still receive a subsidy in 2020 is approximately $50,000, 400 percent of the federal poverty level.

-

Republican plan benefits the rich? Who woulda thunk it?